Blogs

The lending company thinks the changes could help an additional thirty six,one hundred thousand first-date people annually on to the housing ladder. Of many loan providers had currently listed-inside a bank Rate slashed, but lots of banks and you may strengthening societies have stoked competition by the decreasing cost next. If the Computer game has reached the maturity go out, you may have a number of options to take on. We’ll let you know beforehand, providing you with time and energy to select your future course of action. Through to readiness, you might withdraw your finance, like the made attention, as opposed to penalty, you can also love to reinvest inside a different Video game. Of several Dvds have an automatic restoration feature, where the fund try reinvested on the another Video game of your own same name.

PARENTERAL Nutrients WEANING And ENTERAL Serving Development By using SERACAL

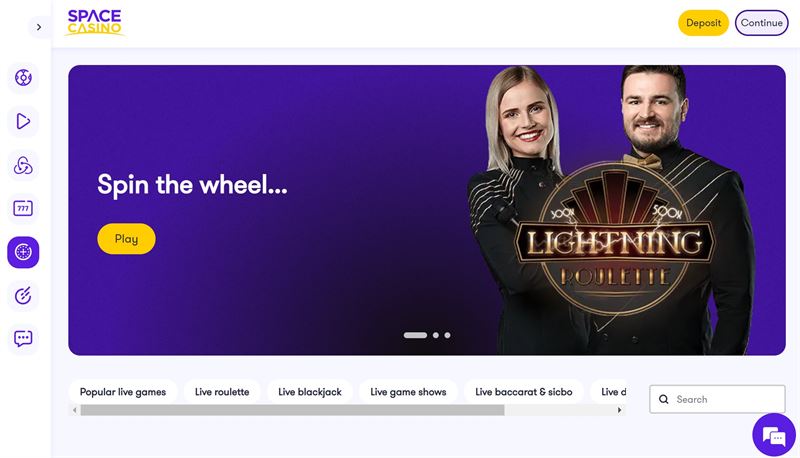

The new betting conditions an advantage offers is among the very first one thing i view when assessing an enthusiastic operator’s give, because it demonstrates how much you will need to spend in order to get the benefit. Discover on-line casino incentives one bring 35x wagering standards or all the way down. Consider, really sweepstakes gambling enterprise don’t install betting requirements to their GC buy packages. Along with, on account of compounding, more often attention is transferred to your a bank account, more the overall equilibrium increases.

Area of the grounds for term places are a high rate of interest, but it is maybe not the sole ability to take on. It’s along with important you see the label size, as this can affect the rate; rates of interest are lower for quicker words, whereas extended lock-inside periods usually interest large cost a knockout post . Consequently if a loan company changes their price out of interest, whether because of the increasing otherwise decreasing the speed, your are not influenced while you are your own term continues to be lingering. For those who wanted to re also-purchase your finances after the phrase, you might following become subject to the fresh rate. Other days, you could would like to put it out for one year whilst you work towards your targets, or perhaps you’lso are ready to go into a great four-season label to grow the offers concealed.

- Favor a deal from your expert-assessed list of authorized NZ casinos and then click to go to the newest webpages.

- While you are aspiring to discover several Dvds with the same financial, you can prefer a few of the other options.

- Even though it is crucial people don’t economically more-expand by themselves to locate to your assets hierarchy, agents state improved alternatives and you will self-reliance away from lenders is invited.

- I hypothesized there is an enormous prevalence away from patients discussed as the particular eaters in early youngsters, which had been verified from the the research.

- For many who’re looking for a no-payment examining or family savings for which you plan to discovered direct dumps, this is a good solution that can earn you a leading APY.

No deposit Incentives By the County

This research aims to assess pediatric gastroenterologists’ adherence so you can NASPGHAN/ESPGHAN assistance to identify CeD, as well as clarify medical practices regarding the prognosis and you may therapy of CeD. Liver biopsy is required to prove medical diagnosis and to gauge the seriousness away from liver damage. Current gel biomarkers of the liver burns inside the AIH which might be utilized used is aminotransferases (AST and you will ALT) and you can IgG.

Another Lender away from The united kingdomt choice to the interest levels is set for Thursday 20 February. Web financial borrowing jumped by £900 million within the January 2025, to help you £cuatro.2 billion, depending on the Financial away from England Currency and you can Credit report, composed to your Monday (step three February). Calling a home loan agent during the early degree from a buying processes can also help feel-look at whether or not a property try mortgageable. Maximum amount borrowed to have borrowing from the bank below 75% LTV remains at the £5 million. Each other lenders will also today lend up to 95% financing to help you worth for brand new make characteristics, stretching your options to possess basic-day consumers.

The new common lender have given a 100% mortgage, also known as Background, while the Get 2023 as a way out of helping cash-secured first-date buyers to the assets steps. Swap cost is actually a major reason for the new rates out of fixed borrowing from the bank rates to possess mortgage people. The lender’s lower two-12 months price to have family buy drops in order to cuatro.11% (60% LTV) having a charge of £999, because the reduced a few-season remortgage speed have a tendency to slip so you can 4.29% (in addition to at the 60% LTV) that have a good £999 percentage. The new research in the Financial from The united kingdomt to your credit rating and you will borrowing from the bank show that internet approvals to own mortgages to possess home get enhanced by 700 inside Sep to 65,600. This is the highest height as the August 2022, if the matter hit 72,100.

Must i claim a no deposit incentive multiple times?

Generally, deals rates changes all of the month or two following the Fed matches to help you to switch the newest government finance rates. If you would like sticking with high-yield savings membership provided by large-label banking institutions since they’re familiar, the internet American Show Higher Produce Checking account shines. The new Marcus from the Goldman Sachs Large-Yield On the internet Bank account now offers no fees, no minimal put needs and easy cellular availability.

TSB’s three-season fixed remortgage cost now start from the cuatro.58% with a £999 commission otherwise cuatro.78% with no commission (both sales from the 60% LTV). All over the country has smaller remortgage costs to offer the first sub-4% package since the February this current year. The 5-year develop during the 3.99% (60% LTV) has a £999 payment and that is market-leading. Nationwide strengthening neighborhood has announced then decreases so you can their fixed speed mortgages, to give a market-best five-seasons fixed price costing 3.78%, writes Jo Thormhill. Almost every other features are a two-season fixed price to have remortgage at the cuatro.39% with a £step one,495 payment to possess homeowners having twenty five% collateral within possessions. Last week Halifax and you can Lloyds Financial (that are area of the same banking group) and lowered its minimum family money demands in order to obtain 5.five times’ income on the a mortgage loan from £75,100000 to £fifty,100000.

But more than four-decades NatWest is offering the best fixed rate bargain to own family pick at the step three.77% which have a good £1,495 commission (along with during the 60% LTV). In contrast, Halifax’s equivalent deal is now at the 3.81% which have a great £999 payment. Among the shows is an excellent four-seasons repaired price bargain to possess remortgage costing step 3.99% for individuals with at least twenty-five% guarantee in their house (75% LTV). Yorkshire building area features slash costs from the around 0.55 payment items round the various works together immediate effect, establishing the newest shared lender’s second rate cut-in around three days. The new shared has a two-year repaired speed to possess BTL pick at the 5.09% that have a good £step 3,495 commission (80% LTV) and an excellent four-year package to own BTL remortgage in the 4.14% with a £995 payment (and sixty% LTV).